NAEPC Webinars (See All):

Issue 47 – October, 2025

Why Older Attorneys Without Adequate Retirement Savings Use Cash Balance Plans to Create Exit Strategies Without Selling Their Business

By: David Swanson

For seasoned attorneys who find themselves without adequate retirement savings, cash balance plans offer a powerful alternative to traditional exit strategies. This article explores how these specializedpension plans enable legal professionals to rapidly build significant retirement funds while enjoying tax advantages without the uncertainty and complications of selling their law practice.

The Retirement Challenge for Older Attorneys

The legal profession presents a unique retirement planning challenge. While attorneys often achieve substantial incomes, the path to financial success typically follows a delayed trajectory due to extensive education requirements and the gradual building ofexpertise and client relationships. By the time many attorneys reach their peak earning years in their 50s or 60s, they frequently discover they will not have adequate retirement savings to retire at the desired age.

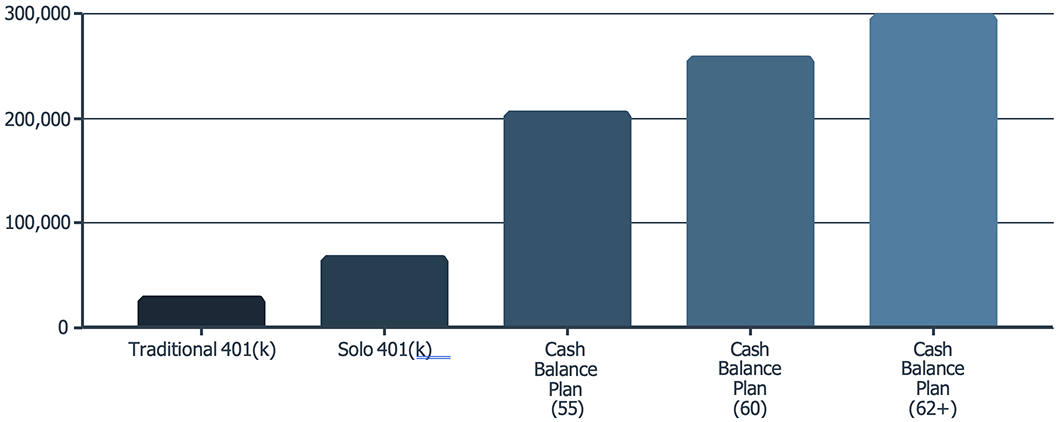

Traditional retirement vehicles prove woefully inadequate for aggressive late-stage retirement planning. 401(k)s and IRAs come with strict contribution limits of just $23,500 plus catch-up contributions for 2025 creating a ceiling that prevents high-earningattorneys from rapidly building sufficient retirement assets they need. For professionals earning $300,000 to $1 million annually, these conventional options simply do not provide the capacity to save meaningfully in relation to their income and lifestyle expectations.

The traditional exit strategy of selling a law practice comes with its own set of challenges. Law practices, particularly those built around individual expertise and relationships, can be difficult to value and sell. The process often involves lengthy transitions,potential earn-out arrangements, and significant tax consequences. Market conditions, changing legal landscapes, and geographical limitations further complicate practice sales, making the sale an unreliable foundation for retirement security.

What Is a Cash Balance Plan and How Does It Work?

A cash balance plan represents a sophisticated hybrid between traditional pension plans and modern defined contribution plans. Unlike familiar 401(k) plans where employees contribute their own money and shoulder investment risks, cash balance plansmay be funded entirely by employer contributions and may provide participants with guaranteed interest credits creating predictable, substantial retirement assets.

Structure and Mechanics

In a cash balance plan, each participant has a hypothetical account that receives two types of credits annually:

- A contribution credit (typically a percentage of salary or a flat dollar amount) funded entirely by the employer; and

- An interest credit (either a fixed rate or tied to a benchmark like Treasury yields) that compounds over time regardless of actual investment performance.

These credits accumulate to create a theoretical account balance that participants can track throughout their career, like a 401(k) balance. This design provides transparency while still delivering the funding advantages of a traditional pension.

Key Differences from 401(k)s

- Employer-funded: Unlike 401(k)s, the business funds cash balance contributions entirely, not employee paychecks.

- Mandatory contributions: Employers must make predetermined annual contributions.

- Age-weighted: Older participants can receive substantially larger contributions.

- Guaranteed growth: Accounts grow at a predetermined interest rate regardless of market performance.

- Professional administration: Plans require actuarial certification and specialized oversight.

At retirement, participants have flexibility in how they access their benefits. Participants can choose to receive their account balance as a lump sum (typically rolled over into an IRA to maintain tax deferral) or convert the account balance into a lifetime annuity. This flexibility provides importantplanning options for attorneys approaching retirement who may have different income needs and tax considerations.

For law firm owners, cash balance plans create a powerful mechanism to accelerate retirement savings while generating substantial current tax deductions. The employer bears investment risk in exchange for these benefits, with funding requirements that ensure the plan maintains sufficientassets to meet the future obligations for all participants.

Why Cash Balance Plans Are Ideal for Older Attorneys Without Adequate Retirement Savings

Cash balance plans offer a uniquely powerful solution for attorneys in their fifties and sixties without adequate retirement savings. Unlike standardretirement vehicles, these plans provide a legal mechanism to rapidly accelerate retirement savings during the final years of a career, creating a pathto financial security that simply is not possible with traditional plans.

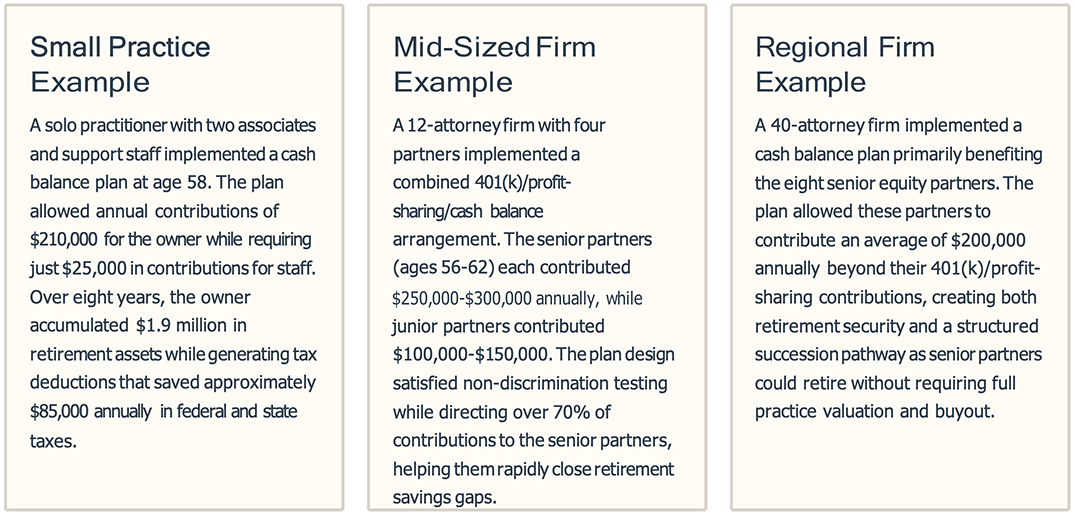

For attorneys who own their practices, cash balance plans offer additional strategic advantages. These plans can allocate higher contributions to favor older owners/partners based on age, compensation, and ownership status all while providing appropriate benefits to non-owner employees satisfying IRStesting requirements. This design flexibility makes cash balance plans particularly attractive for small to mid-sized firms with established partners nearing retirement.

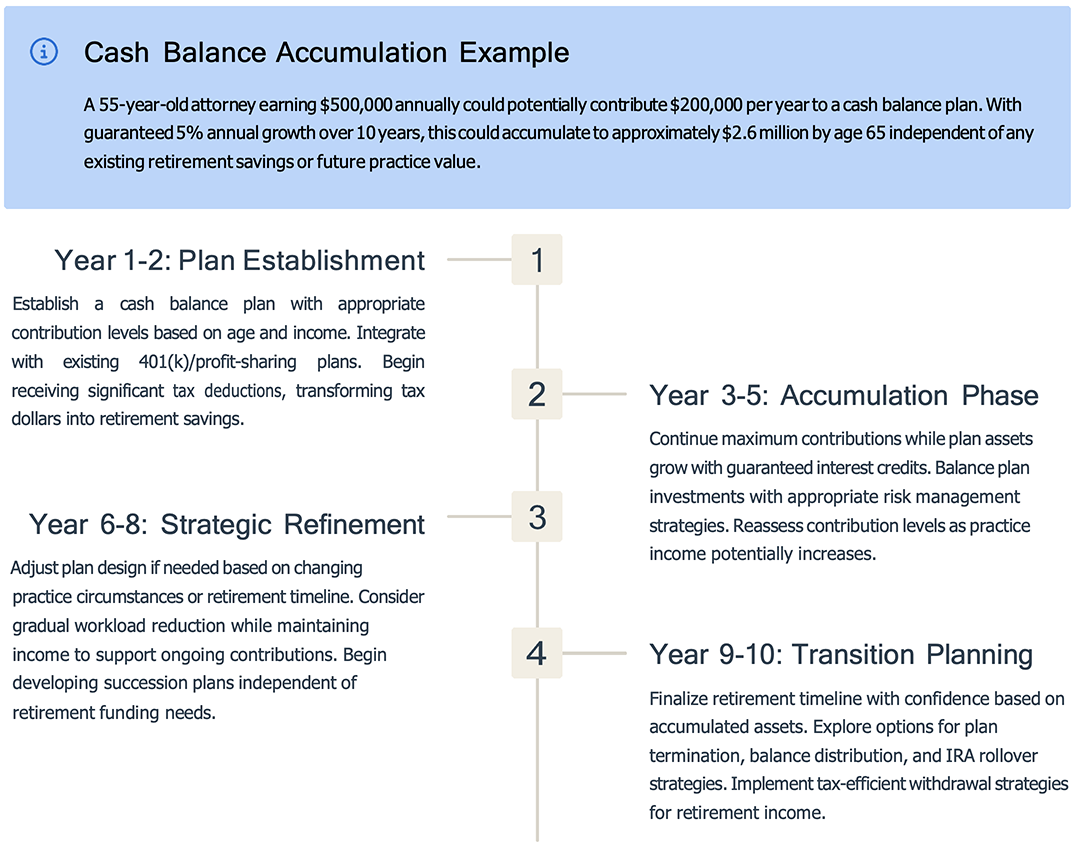

Creating a Multi-Million Dollar Exit Strategy in 10 Years

For attorneys in their fifties or early sixties who have not adequately planned their retirement savings, cash balance plans offer a rare opportunity andability to build significant dollar retirement accounts in only a decade, without relying on practice valuation or sale. The accelerated timeline transforms retirement planning from a source of anxiety into a structured, achievable strategy.

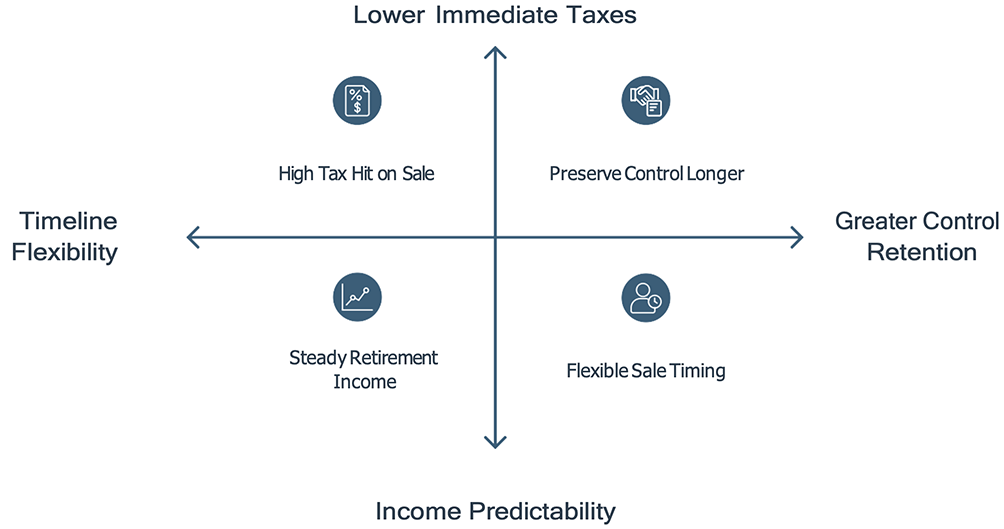

This cash balance plan approach creates strategic advantages beyond simply accumulating retirement assets. By separating retirement funding from practicetransition, attorneys gain negotiating leverage and timing flexibility. Attorneys can potentially retain ownership interests and income streams from theirpractice while drawing on their cash balance assets for primary retirement income. This control allows for more thoughtful succession planning basedon finding the right leadership rather than maximizing sale price.

The age-weighted design of cash balance plans also helps address succession planning challenges. Senior attorneys can benefit from outsized contributions while providing more modest retirement benefits to junior partners and associates. This feature creates a financially sustainable model for the firm while allowing senior partners to achieve their retirement goals without placing excessive financial burdens on the next generation of firmleadership.

Avoiding the Pitfalls of Selling the Practice

For many attorneys, the traditional exit strategy of selling their practice comes with significant challenges and potential pitfalls that can undermineretirement security. Cash balance plans provide a powerful alternative that addresses these challenges while creating more predictable outcomes.

The Sale Dilemma

Selling a law practice is notoriously difficult and unpredictable. The value of most law practices is intrinsically tied to the reputation, relationships, andexpertise of the departing attorney, making valuation complex and often disappointing. Finding qualified buyers with both the capability and capitalto purchase a practice adds another layer of complexity.

The sale of a law practice may trigger significant tax consequences. Proceeds may be subject to capital gains taxes of up to 23.8% federal plus state taxes,immediately reducing the net amount for. Additionally, some sales often require extended earn-out periods or seller financing, creating ongoing risk and delayed access to funds at precisely the time attorneys want financial certainty.

The Cash Balance Plan Advantage

Cash balance plans circumvent these challenges of the law practice sale by creating tax- advantaged retirement assets independent of practice valuation or sale. Contributions generate immediate tax deductions (often at the highest marginal rates of greater than 37%+ when combining federal and state taxes), versus practice sales which generate tax liabilities.

This approach shifts retirement funding from an uncertain future transaction to a structured annual process under the attorney’s control. Retirementassets accumulate predictably through mandatory contributions and guaranteed interest credits, eliminating the need for the practice to maintain its value until retirement.

Importantly, cash balance plans provide flexibility in practice transition. Attorneys can choose to gradually reduce their workload, bring in juniorpartners, or eventually sell their practice all without their retirement security depending on the financial terms of these arrangements.

From a tax efficiency perspective, cash balance plans offer clear advantages. Contributions generate deductions at ordinary income tax rates (potentially 37%+ federal plus state taxes) during high-income working years. Later, distributions in retirement may be subject to lower tax rates as income typically decreases. This tax rate arbitrage (deducting at high tax rates and potentially withdrawing at lower tax rates) creates additionalretirement value beyond the actual contribution amounts.

Real-World Examples and Industry Adoption

Cash balance plans have gained significant traction among law firms of all sizes, with adoption accelerating as more attorneys recognize their uniqueadvantages for late-career retirement planning. Industry data shows the number of cash balance plans has more than tripled over the past decade,with particularly robust growth among professional service firms including law practices.

The flexibility of cash balance plans makes them adaptable to various firm structures and succession scenarios. For firms with multiple generations ofpartners, these plans can facilitate smooth transitions by:

- Allowing senior partners to achieve retirement security independent of firm valuation

- Providing junior partners with time to grow into leadership roles without immediate buyout pressure

- Creating predictable retirement funding obligations that can be planned for within the firm’s financial structure

- Offering recruitment and retention advantages for attorneys at all career stages.

Adoption patterns show cash balance plans may work particularly well for attorneys with irregular income patterns, such as contingency-fee practices,as they allow for larger contributions during high-income years. The plans’ inherent flexibility regarding contribution levels (within certain actuariallimits) makes them adaptable to the financial realities of various legal specialties and practice models.

Conclusion: A Powerful, Tax-Smart Retirement Solution for Older Attorneys

For attorneys who find themselves without adequate retirement savings in their fifties or sixties, cash balance plans offer a uniquely powerful solutionthat addresses the specific challenges of the legal profession. These sophisticated retirement vehicles provide a structured pathway to significantretirement accounts within a decade without requiring practice sale or valuation.

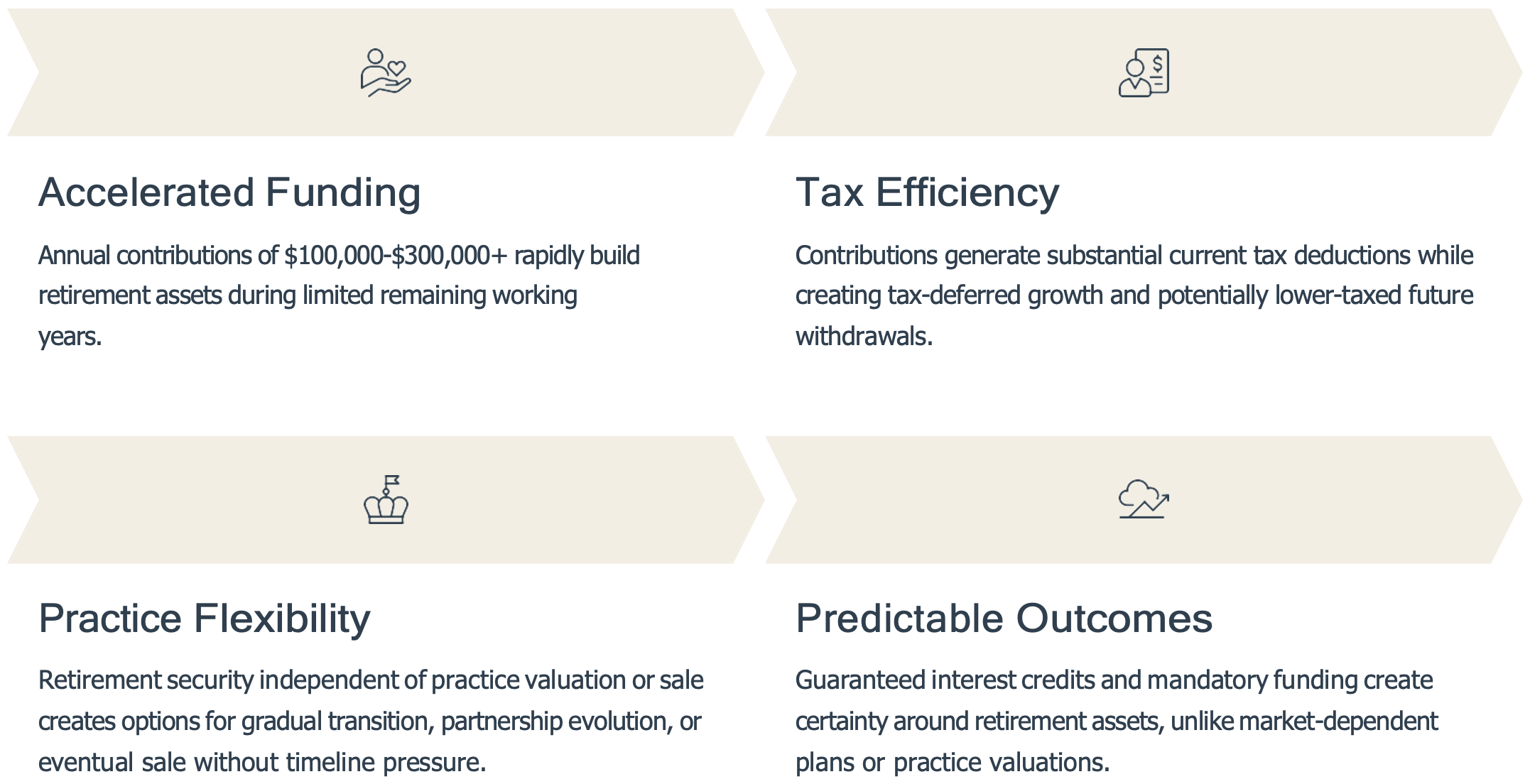

The distinctive advantages of cash balance plans directly address the retirement planning obstacles successful attorneys may face:

To implement this strategy effectively, attorneys should seek specialized advisors who understand both the unique aspects of legal practices and thetechnical requirements of cash balance plans. These specialists typically include:

- A pension actuary experienced in cash balance plan design for professional practices.

- A tax advisor who can optimize the plan’s structure for the specific firm and owner circumstances

- A financial advisor who can integrate the cash balance strategy with overall retirement and estate planning

- A third-party administrator who understands the ongoing compliance requirements.

While cash balance plans involve more complexity and administration than simple 401(k) plans, the extraordinary benefits they provide for retirement-focused attorneys far outweigh these considerations. For attorneys who have delayed retirement planning while building their practice,these plans transform what might seem like an insurmountable retirement gap into an achievable exit strategy.

By embracing this approach, attorneys can redirect their focus from retirement planning anxiety to continued professional excellence and thoughtful practice transition. They can be secure in the knowledge that their financial future is being systematically built through a tax-advantaged structure specifically designed for their circumstances. This strategic combination of retirement security and practice flexibility represents the ideal exit path forthose attorneys who want to finish their careers on their own terms.

David Swanson is the Managing Partner at Oakwood Summit

E. david@oakwoodsummit.com

W. oakwoodsummit.com

The information provided is for general informational and educational purposes only and is not intended to be and should not be construed as legal, tax,investment, or accounting advice. You should consult your own legal, tax, and financial advisors before making any decisions based on the informationprovided. Cash Balance Plan services offered through this site are provided as part of a consulting relationship and may involve coordination with third-party actuaries, TPAs, and investment advisors. While we strive to ensure accuracy and compliance, we do not provide legal or tax filing services. Allplan designs are subject to IRS rules and Department of Labor regulations and may vary based on individual business circumstances. Past results arenot guarantee of future outcomes. The value of tax savings and retirement benefits will vary depending on your income, entity structure, contributions,and overall financial strategy. For specific advice tailored to your situation, please schedule a consultation with a qualified advisor.