NAEPC Webinars (See All):

Issue 26 – May, 2017

Editor’s Note

The Future Is Now – And We Have Proof!

Susan P. Rounds, JD, CPA, LL.M. (taxation), AEP®, TEP

Susan P. Rounds, JD, CPA, LL.M. (taxation), AEP®, TEP

As planners, one of our motivations is to help our clients anticipate change so they can position themselves to take advantage of that change. Because the hard part is knowing exactly how and when those changes will occur, many of the authors contributing to this edition of the NAEPC Journal of Estate and Tax Planning point out that flexibility is key to advancing that goal so that clients can keep more of their hardearned dollars and use them to benefit family, business and community.

Strategies to incorporate flexibility as a fundamental basis of an estate plan are outlined in detail throughout, as are articles discussing the events that have occurred over time leading us to where we stand now, the precipice of the future of estate planning. Still, in spite of the possibility of dramatic alterations in the fabric of U.S. tax law, with respect to fundamental estate planning objectives certain elements will remain true. Clients will have the same “core of four” comprising the underlying wish-list when it comes to transfer planning for their assets: Control, Use and Enjoyment, Protection and Tax Efficiency.

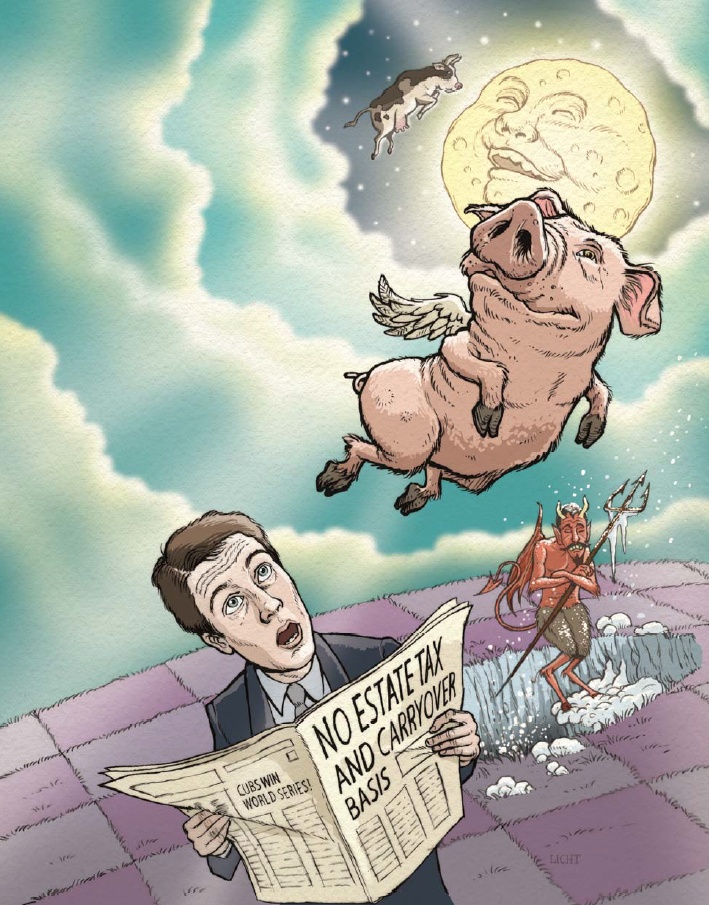

We have one more element to factor in (illustrated in hard dollars in this issue): The Cost of Procrastination. The cost of not planning while waiting to see what the future brings is a hidden liability on the family balance sheet. Well, the future is now! Haven’t seen a pig fly, yet, but scroll down and look closely at the art created by Max Licht for the ABA Journal and don’t miss the back cover of the newspaper. Then, check out the copyright to see when this was created.

Happy Reading!

“Knowledge is weightless, a treasure you can carry easily” – Anonymous

Email me at editor@naepcjournal.org with your opinions and suggestions.

Used by permission. Cover of ABA Journal May/June 2007, Vol. 21 No. 3. Art by Max Licht www.maxlicht.com.

This information is provided for discussion purposes only and is not to be construed as providing legal, tax, investment or financial planning advice. Please consult all appropriate advisors prior to undertaking any of the strategies outlined in this article, many of which may involve complex legal, tax, investment and financial issues. This communication is not a Covered Opinion as defined by Circular 230 and is limited to the Federal tax issues addressed herein. Additional issues may exist that affect the Federal tax treatment of the transaction. The communication was not intended or written to be used, and cannot be used, or relied on, by the taxpayer, to avoid Federal tax penalties. MRG026830