NAEPC Webinars (See All):

Issue 35 – September, 2020

Editor’s Note

Estate Planning for 2020 and Beyond

Susan P. Rounds, JD, CPA, LL.M. (taxation), AEP®, TEP

Susan P. Rounds, JD, CPA, LL.M. (taxation), AEP®, TEP

The estate and gift tax exemption, which allows each U.S. citizen and domiciliary to pass a certain amount of assets free of the federal estate and gift tax, was doubled under the Tax Cuts and Jobs Act enacted in December 2017. The current inflation-adjusted estate and gift tax exemption is $11.58 million per person ($23.16 million per married couple); however, this increased amount is set to expire in 2025 and revert to a $5-million base per person. Further, there is legislative risk that the increased amount may be reduced even earlier depending on 2020 election results.

In addition to the estate and gift tax, there is also a federal generation-skipping transfer (GST) tax. The GST tax generally applies to a transfer to someone more than one generation below that of the donor, such as a grandchild. The 2020 GST exemption amount is also $11.58 million per person. By way of illustration, if you were to make an outright transfer during your lifetime to your grandchild in the amount of $100,000, there would be a 40-percent gift tax applied as well as a 40-percent GST tax. The total tentative tax (before applying exemption amounts) on the transfer would be $80,000. Of course, you would have the opportunity to apply your unused exemption amounts against the gift to offset the taxes.

The vast increase in the estate, gift, and GST tax exemptions provides a rare opportunity to benefit your heirs. Further, the Internal Revenue Service (IRS) recently provided that you won’t be penalized for exhausting a higher exemption now even if it is later reduced. Gifting all or a portion of the exemption now to a dynasty trust may provide a wealth-building opportunity because trust assets are not exposed to estate tax at each generation. Specially drafted trusts such as a spousal lifetime access trust (SLAT) may provide a unique solution, allowing you to take advantage of the estate and gift tax exemption, but with a potential safety net because the beneficiary-spouse may still access those assets if needed. A SLAT can be designed as a dynasty trust.

The increased exemption amounts also may be used to augment a trust strategy that involves the sale of assets to an intentionally defective grantor trust (IDGT) in exchange for a promissory note from the trust. The sale arrangement typically involves an initial gift to the trust equal to 10 percent of the value of the assets, such as privately held stock, that will be sold to the trust. The 10-percent pool is created at the beginning to establish an initial fund for payment of the note by the trust. In addition, the opportunity to gift assets to a specially designed life insurance trust is enhanced. These trusts can be used to provide cash to pay estate taxes and also may be used as a wealth-creation tool. Finally, incorporating the annual gift tax exclusion, currently $15,000 per donee, is important to round out your estate plan and gifting strategy.

Protecting Wealth Across Generations

If you have already used your prior $5+ million exclusion ($10+ million if you’re married), you now can make additional gifts without incurring gift tax. You could, for example, give more to an existing trust for your children and grandchildren that you perhaps created under favorable Delaware law—a so-called “dynasty trust” that can last for multiple generations without additional transfer tax—or you could simply give more outright to your children or grandchildren.

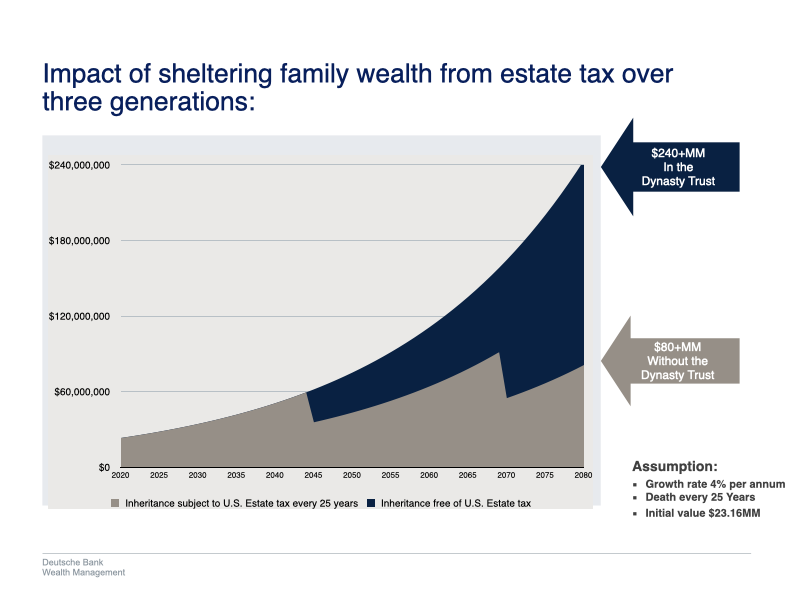

A dynasty trust fully funded in 2020 by a married couple in the amount of $23.16 million growing at a rate of 4 percent will increase to $243,634,571 in the year 2080. If the same amount were subjected to estate tax every 25 years, the amount remaining for the benefit of heirs would be $81,091,388, as illustrated in figure 1.

Figure 1: Impact of Sheltering Family Wealth from Estate Tax over three generations

Spousal Lifetime Access Trust

Transferring assets out of the estate now to reduce estate taxes later is often a good strategy, but individuals may be reluctant to make a large gift to take advantage of the high exemption because they fear losing access to the transferred funds. The spousal lifetime access trust may provide a solution. A SLAT is a type of irrevocable trust that may be used to preserve the transfer tax benefit of the increased exemption amount while also building flexibility into the estate plan.

A SLAT is an irrevocable trust established by one spouse for the benefit of the other spouse and the couple’s children and/or grandchildren. It requires use of the donor spouse’s exemption amount to protect the transfer from gift tax. When funding the SLAT, the grantor-spouse should use his or her separate property, as opposed to jointly owned or community property (this could make the transferred property includible in the estate of the beneficiary-spouse).

Spousal access to the funds in a SLAT is not unlimited. If distributions are made to the beneficiary-spouse, who consistently uses them to benefit the grantor-spouse, this could be considered a retained interest on the part of the grantor-spouse and make the trust assets includible in the grantor-spouse’s estate for estate tax purposes.

If there is a divorce or the beneficiary-spouse dies, the grantor-spouse will lose indirect access to the trust. Accordingly, the grantor-spouse may want to limit the amount transferred to the trust, or provide that if the grantor remarries, the new spouse will be a trust beneficiary or that the trustee may lend trust property to the grantor.

The SLAT is an important tool that may allow a grantor-spouse to take full advantage of the increased exemption amount while permitting indirect access to the trust funds by way of the beneficiary-spouse’s interest. Ideally, however, this access would never be needed, and as long as the grantor-spouse is still responsible for paying the trust’s income tax liability, an even greater amount of assets will pass to the next generation, free of federal estate and gift tax.

Sale to an Intentionally Defective Grantor Trust (IDGT)

If you own assets that are expected to appreciate significantly, such as a new business venture or property that has temporarily declined in value, the increased estate tax exemption amplifies the opportunity to pass the potential growth in a tax-efficient manner to your heirs. One way to do this is by selling these assets to a “defective” grantor trust—a trust that you “own” for income tax but not estate tax purposes (that’s what makes it “defective”). In this scenario, you create a trust for children and grandchildren, and fund it with approximately 10 percent of the property you’re going to sell to the trust. Once you’ve completed the sale, you take back an interest-bearing note.

Assuming the assets you sold to the trust outperform the note’s interest rate, the appreciation passes to the trust beneficiaries without gift tax and due to the trust’s “defective” structure, there are no income tax consequences on the transaction. There is an even greater potential for future appreciation on assets transferred to a trust now given the fact that many valuations are currently depressed.

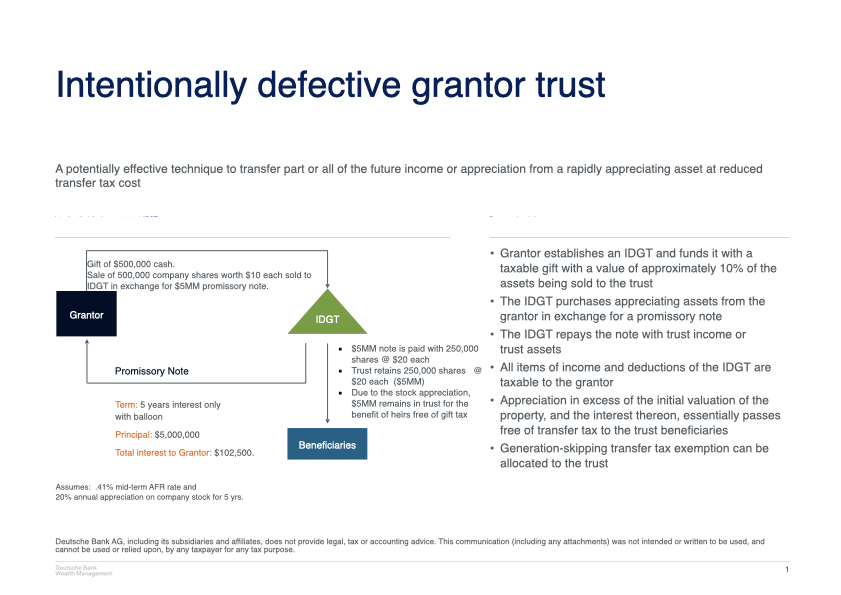

Let’s analyze the potential outcome of this strategy for Maria, who intends to take her privately held company public within the next 12 to 18 months. Following a round of venture capital financing, the company’s stock is now worth $10 per share. Maria believes that the value of the shares will increase when her company goes public. In August 2020, she establishes an IDGT for the benefit of her heirs and funds it with a gift of $500,000 in cash.

Maria then sells 500,000 shares (total value $5 million) to the IDGT in exchange for a promissory note. The note requires “interest only” for five years with a balloon payment of principal at the end of the term. Interest will be paid annually at the IRS-required rate of interest for a mid-term note, which is set at 0.41 percent for August 2020. Because the trust is a grantor trust, no gain or loss is recognized on the sale to the IDGT or on the annual interest payments that Maria will receive in the amount of $20,500.

Assume that five years later the stock is worth $20 per share. The trustee may pay the $5-million note by distributing 250,000 shares to Maria. The $102,500 in interest payments will have been satisfied through payment of company dividends on the shares held in the trust. After the note is paid in full, the trust still has 250,000 shares that are now worth $5 million.

This example is illustrated in figure 2.

FIGURE 2: Intentionally defective grantor trust

Increased Returns with Life Insurance

Life insurance can be used to provide funds to pay estate taxes that may be imposed if your estate exceeds the exemption amount. Insurance also can provide liquidity when estate assets are illiquid and cannot be converted efficiently into cash (such as real estate, art, or closely held businesses). To insulate the life insurance proceeds from estate tax at your death, a specially drafted trust will own the insurance. Funding an “insurance trust” so that it can afford to purchase substantial insurance can be complex, but the larger exemption allows more assets to be gifted to the trust free of gift tax. This simplifies the funding, reduces the potential gift-tax complications, and provides resources to the trust to purchase a larger life insurance policy on you or your spouse. The insurance held in the trust will mature upon the death of the insured, providing a liquid source of funds to pay any estate taxes that become due. Any remaining proceeds are held in the trust for the benefit of the beneficiaries.

Tax-Efficient Gifting

Gifts you make to others during your lifetime are potentially subject to federal gift tax. However, you can exclude gifts of up to $15,000 per donee per year in 2020. Referred to as the annual gift tax exclusion, this amount is adjusted annually for inflation. This exclusion increases to $30,000 per donee if both spouses join in making the gift. Thus, if only one spouse gifts $30,000 to one person, both spouses can elect to “split the gift” on a gift tax return and treat it as if they each gave $15,000. You can make gifts to as many people as you like each year. An annual exclusion gift must convey a present interest to the donee, such as cash or stock given outright or transferred into certain trusts.

The Perfect Time for Planning

A confluence of more time on our hands due to changing societal circumstances, an urgent reminder of the important things in life, changing economic conditions, and fairly recent tax law changes have created the perfect storm for estate planning. Interest rates published monthly by the IRS set the hurdle for some trust strategies and are historically low, with the October rates ranging from 0.14–1 percent. In addition, depressed valuations on some assets provide more opportunity to transfer the potential upside. Locking in these rates and values now may put you in a position to pass a large amount of appreciation (growth in excess of the hurdle rate) to the next generation with no gift or estate tax. Trust strategies that allow you to take advantage of these factors are sophisticated and you may want to consider choosing an independent trustee to administer the trust and handle reporting and tax preparation requirements. Finally, note that state taxes, which usually vary from federal taxes, must be incorporated into any planning decisions you make.

Happy Reading!

“Knowledge is weightless, a treasure you can carry easily” – Anonymous

Email me at editor@naepcjournal.org with your comments and suggestions.

The opinions and analyses expressed herein are those of the author and do not necessarily reflect those of Deutsche Bank AG or any affiliate thereof (collectively, the “Bank”). Any suggestions contained herein are general, and do not take into account an individual’s specific circumstances or applicable governing law, which may vary from jurisdiction to jurisdiction and be subject to change. No warranty or representation, express or implied, is made by the Bank, nor does the Bank accept any liability with respect to the information and data set forth herein. The information contained herein is not intended to be, and does not constitute, legal, tax, accounting or other professional advice; it is also not intended to offer penalty protection or to promote, market or recommend any transaction or matter addressed herein. Recipients should consult their applicable professional advisors prior to acting on the information set forth herein. This material may not be reproduced without the express permission of the author. “Deutsche Bank” means Deutsche Bank AG and its affiliated companies. Deutsche Bank Wealth Management represents the wealth management activities conducted by Deutsche Bank AG or its subsidiaries. Trust and estate and wealth planning services are provided through Deutsche Bank Trust Company, N.A., Deutsche Bank Trust Company Delaware and Deutsche Bank National Trust Company. © 2020 Deutsche Bank AG. All rights reserved. 029298 081120