NAEPC Webinars (See All):

Issue 41 – January, 2023

Maximizing Life Settlement Value Through a Policy Auction

By Jamie Mendelsohn, EVP Ashar Group, LLC

Life insurance can be the largest unmanaged asset that a client owns, and it is rarely appraised or valued. Policy owners allocate significant liquidity on an ongoing basis, many times long after they transition out of the original need that the policy was put in place to protect. Even after a traditional policy review and exploring historical non-forfeiture options such as a surrender, reducing the death benefit, or 1035 exchange, the client is left feeling as if they are not in an optimal position. Creating awareness and educating policy owners that the life settlement market exists can result in many planning opportunities, as well as mitigating risk and liability for the advisory teams. Asking the simple question, “When was your life insurance last appraised” can be the catalyst for many planning discussions.

Many policy owners have paid into policies for decades and want more than the intrinsic value of ownership when considering exiting it. The opportunity to take advantage of a secondary market, to capitalize on the numerous institutional buyers competing in an auction to deliver more value than other exit strategies, is an important option to discuss with policy owners. Getting clients in the habit of valuing their life insurance, similar to how they appraise other assets, could create additional cash flow for other planning needs.

The definition of a life settlement is the sale of an existing life insurance policy for an amount greater than the cash surrender value, but less than the death benefit. The existence of a secondary market that will purchase a policy gives policy owners the opportunity to appraise and monetize their existing life insurance policies for potentially more than what the carrier would give them for the same policy. This alternative can fund other business, retirement, and/or caregiving needs. It also could free up cashflow by reallocating premium dollars to fund coverage for adult children or grandchildren. A life settlement isn’t a product sale. It is a solution that when viable and appropriate can be a better alternative than surrendering or allowing an existing policy to lapse.

Life Insurance is an Asset

Life insurance is an asset that is often not a line item on a balance sheet or recognized as a piece of property that a client owns. It should be treated like any other asset. Treating life insurance as an asset allows it to be the vehicle to create cash flow for other planning needs. Like real estate, art, and jewelry—before your clients decide what to do with it, it should be valued. Once they understand the value, they can act.

Life insurance has three potential exit values: the death benefit, the cash surrender value (CSV) or its fair market value (“FMV”). Policy owners can appraise life insurance policies, even term insurance, for its FMV in the life settlement market. This gives a policy owner the opportunity to maximize its value rather than just lapsing or surrendering the policy back to the insurance carrier for minimal value. How did life insurance become classified as property and viewed as an asset? According to the Government Accounting Office report on life settlements, “The right of conveyance stems from a 1911 Supreme Court decision, Grigsby v. Russell. The Supreme Court noted that it was desirable to give life insurance the characteristics of property.” Many consider Grigsby v. Russell as the genesis for life settlements. However, the many advantages of uncovering the FMV of life insurance would not be fully realized until almost a century later in the institutional secondary market.

Through consideration of a life settlement, advisors and their clients can appropriately value and potentially monetize life insurance policies to solve immediate financial or non-tax planning needs. The life settlement option is particularly relevant when: (1) a client plans to cease paying premiums; (2) the policy’s cash value is declining; and/or (3) the client outlives or otherwise no longer needs the insurance coverage for its intended planning purpose. Life settlements also can support exit strategies for underfunded (or poorly performing) policies owned in irrevocable insurance trusts, as well as unwinding complex structures like premium finance and split-dollar for additional value. This solution continues to be integrated into estate and business planning, and it should be included when financial professionals and fiduciaries make an assessment in the client’s “best interests.”

Over the past 20 years, regulation and transparency have increased in the market, resulting in the life settlement option being available in all states. Departments of insurance and financial services around the country regulate these transactions and require market participants to be licensed and have their forms and authorizations approved for use with consumers.

The Market Participants

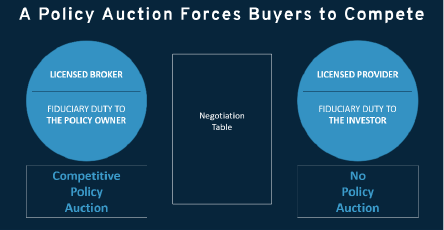

The market today is highly regulated and there are specific licenses for the parties that represent the policy owner and for those that represent the investor. These two licensed parties are the life settlement broker, who serves as the seller’s representative, and the life settlement provider, who serves as the buyer’s agent. The broker is 100% aligned with the policy owner and has a duty to provide transparency and a best practice approach to the market. The broker’s role is to craft the strongest negotiation possible to deliver the highest FMV for the life insurance policy. Brokers do this by managing a life insurance policy auction that puts providers in competition with each other, forcing them to bid against each other to purchase the insurance policy from the policy owner.

Like other property sales, competition drives more value to the seller. Knowing the different market participants and ensuring your client is aligned with a party that represents them in the auction is very important. In a recent sale, a male age 75 with a $3 million guaranteed universal life policy, initially reacted to advertising by a provider, a single buyer, to whom he was going to sell his policy for $180,000. The client and his advisory team went to a life settlement broker who negotiated 30 bids, resulting in a sale price of $270,000. Seller representation, competition and negotiating on the policy owner’s behalf delivered an additional $90,000 to the policy owner. The sale created the cash flow for the client’s other planning needs, as well as mitigated risk to the advisors by ensuring they had documented a best interest, best practice approach to the market.

Helping clients to recognize the importance of knowing the value of a policy before making any decisions or taking any actions will have long lasting impact. Discussing the opportunity to take an illiquid asset and monetize it when clients are going through a financial transition, whether to fund business, retirement, long term care or charitable endeavors, can be a powerful client conversation.

Business Owned Life Insurance

According to a Wharton School Study, “almost 85% of term policies fail to pay a death claim; nearly 88% of universal life policies ultimately don’t terminate with a death benefit claim.” Many of these low cash value polices were forfeited back to the insurance company for their cash surrender value without anyone in the planning community asking for an appraisal to uncover any additional life settlement value. It is important to understand that you don’t need to be a life insurance expert to help your clients uncover life settlement value and protect their best interests. In another example, a seller’s representative worked with an advisory team to a retiring business owner to value an existing $3 million term life insurance policy. The business owner was going to allow the policy to lapse; however, the advisory team went through the valuation process and the life settlement auction. After 18 bids, the policy sold for $490,000.

Questions to Ask When Selecting a Life Settlement Resource

- Are you a licensed provider that buys policies with a fiduciary duty to investors, or a licensed broker that forces a policy auction, acting as a fiduciary to the policy owner?

- Are life settlements your core business? How many life settlements have you completed in your career?

- Will you disclose your pricing and value analysis, as well as longevity underwriting to select life expectancy estimates?

Ideal Client for the Current Market

The life settlement solution will be most relevant to retirement-age clients. However, we recommend you discuss this option with all policy owners and interested parties to your clients’ life insurance assets. If the life settlement sale is the outcome of the valuation, the owner(s), insured(s), and beneficiary (s) are required to sign off on the sale. Most market buyers are purchasing policies on insureds over the age of 70, that is, those with life expectancies under 18 years. Nonetheless, there is a limited market for insureds under age 70 if certain variables exist. Many times, the policies that are most interesting to purchasers will have some type of health arbitrage since the origination of the policy (e.g., insureds rated preferred at issuance of a policy but who now fall in a standard or sub-standard rating class). Most buyers will require the last three years of medical records on the insured for their medical underwriting reviews. Unlike the initial medical underwriting process, the life settlement process isn’t physically invasive for the insured as there are no required medical exams or blood tests. Buyers are analyzing the medical history to determine the life expectancy/ longevity data points on the insured(s). There are a limited number of buyers who will consider purchasing a policy without any medical records.

There are buyers for all policy types with face amounts of $100,000 to $50 million+ on individuals or survivorship policies. Universal life (“UL”) policies are usually the most competitive in today’s market. The following policy types have the highest demand in the current market: guaranteed universal life (“GUL”), as well as policies with riders, such as no-lapse guarantee (“NLG”) and return-of-premium. There is interest in all UL products, as well as in term insurance that is convertible to a UL product. Whole life (“WL”) products have a limited market, since most WL products have high cash values, and the majority of buyers don’t want to take cash to buy cash. There is current capital in the market looking to purchase WL policies on insureds over the age of 65; however, it is limited in scope.

The types of institutional capital purchasing life insurance policies are private equity, hedge funds, pension funds, large multifamily offices, and asset managers. These buyers are looking for high single digit, low double-digit rates of return and there is a high demand in the market for life insurance policies. Many of these investors view their allocation in the life settlement space as part of their alternative asset allocation.

Aging Population Increases Demand

Due to the maturity of the secondary market for life insurance, and health arbitrage that has been fueled by increasing longevity, the stage has been set for you to help many of your clients reaching retirement age and beyond. According to the U.S. Department of Health Statistics, Americans aged 85 and older are the fastest growing demographic group. Furthermore, individuals at higher income levels are likely to live 8-12 years longer than their counterparts at lower income levels because of access to better health care and a healthy lifestyle. Currently, there are approximately 70,000 people in the US over the age of 100; by 2045, this population is expected to number over 700,000. Does the planning you are doing with your clients take into consideration them living well into their 80s, 90s or past 100? Is there a risk if you aren’t managing your clients’ life insurance policies assuming they could live well into these later ages?

Where to Identify At-Risk Policies

If you are working with retirement age clients or persons that sit on the boards of companies or charities, integrating the policy review and valuation of their life insurance assets can have meaningful results. With the changing landscape of life insurance, many policy owners don’t understand their insurance or how the products vary in their premium needs. UL policies require the most management. Many of these policies have been severely impacted by a sustained low interest rate environment. What happens to an ILIT that is holding a UL policy if the agent who sold the policy has since retired or is deceased? Who is managing the policy performance? What happens if the insured is living much longer than expected and premium requirements are increasing dramatically? It has been our experience that most ILIT trustees, planned-giving departments of charities and businesses don’t routinely appraise their policies.

Imagine a decision made by an ILIT trustee to discontinue paying premiums because they were escalating and too expensive. This is a fact pattern we went through with a healthy client that expects to live well into his 90s. The trust owned a $2 million GUL policy on a male age 87 in good health with a zero cash surrender value (“CSV”). The policy premiums were escalating, and the decision was made to surrender the policy. On the surface that would seem like a logical decision. However, a policy valuation revealed significant value. We represented the policy owner and advisory team in the negotiations and sale of the policy. During the auction stage, more than a dozen offers were negotiated to secure a FMV of $665,000. The sale resulted in a big win for the family, with the trust beneficiaries satisfied and the trustee not having the liability that may have resulted if instead the trustee had surrendered the policy for $0. The moral of the story is that before making any material changes, all life insurance policies should be appraised for FMV.

Liquidating a policy to Fund Long Term Care and Retirement Needs

Many older clients own one or more life insurance policies and often drop their policies because their original need no longer exists, they want to eliminate escalating premium payments, they are living longer than expected, or they just need some additional liquidity to help with medical and retirement needs. Below are descriptions of two additional life insurance FMV solutions that ended in a life settlement:

- Funds needed for long term care (LTC) expenses – An advisor contacted us about a $100,000 policy on a 90-year-old male that was no longer affordable. His adult children were helping to pay his skilled nursing home costs. The client’s daughter voiced concerns about her cash flow to the advisor, who then educated her about the life settlement option. The decision was made to appraise the policy and determine its viability for the market. It qualified for sale and after receiving a half dozen offers in the auction, sold for $56,000, delivering capital to fund the client’s skilled nursing home expenses for a few years.

- Policy no longer needed – Many clients outlive the need for their life insurance. A recent sale was the result of a healthy couple age 90 and 89 that no longer wanted to fund a policy since its purposes no longer existed. After negotiating 29 offers in the market, their $2.9 million policy sold for $300,000 over its surrender value. The client was thrilled to have use of those dollars today versus having to pay another approximate $1.8 million into the policy (based on their longevity estimates).

Ensuring your clients have seller representation, which will force competition among multiple buyers, will help protect you and your clients in a life settlement transaction. Recognizing life insurance as a potentially valuable asset can help clients with retirement, wealth preservation, LTC, bankruptcy, divorce, charitable and other financial planning needs.

PRACTICE TIP:

Always secure an appraisal of your clients’ existing life insurance prior to making any material changes to a policy. Add this simple question to your annual review and check list – “When was the last time your life insurance was appraised?”