NAEPC Webinars (See All):

Issue 42 – July, 2023

New RMD and QCD Planning Opportunities from SECURE “2.0” and a Flow Chart for Your Clients

By Paul M. Caspersen, CFP®, MS (Financial Planning & Taxation), AEP®

In late December of 2022, President Biden signed into law H.R. 2617, the Consolidated Appropriations Act 2023. The Act includes the provisions of the so-called “Secure 2.0 legislation,” which made many significant changes to the retirement savings landscape in the United States.

IRA RMD Age Increases

One of the primary changes expected with the passing, and included in the final law, was the age for required minimum distributions (RMD) from an IRA increase to 73 on January 1, 2023, and to 75 on January 1, 2033. IRA owners who turn 72 in 2023 will not be required to take RMDs in 2023.

Secure 2.0 also created new possibilities for charitable strategies described in section 307 of H.R. 2617 for Qualified Charitable Distributions.

QCD Limit Increase

The Qualified Charitable Distribution (QCD) originated from the Pension Protection Act (PPA) of 2006, which introduced a new section to the Code, IRC 408(d)(8). Since then, the QCD has been widely used as a tax-efficient way for individuals aged 70½ or older to make charitable donations directly from their IRA accounts. The law will index the annual IRA QCD limit of $100,000 for inflation, effective for tax years after 2023. The QCD age and restrictions on donating to specific organizations, such as DAFs, supporting orgs, and private foundations, remain unchanged.

New Section of the Code: 408(d)(8)(f)

The law adds a new section, F, to the QCD rules established in IRC 408(d)(8) that includes a one-time election for donors to make a QCD of up to $50,000 to fund either a Charitable Remainder Unitrust (CRUT), Charitable Remainder Annuity Trust (CRAT), or Charitable Gift Annuity (CGA) through a split-interest entity.

The owner of a traditional IRA may now distribute up to $50,000 from the IRA directly to a new charitable remainder trust (CRT) or charitable gift annuity (CGA). These provisions are effective as of January 1, 2023. There are, however, several limitations to this new benefit.

- The donor must be at least 70 ½ years of age at the time of the distribution from the IRA to the CRT or CGA.

- The new law allows the owner of an IRA to make a qualified charitable distribution (QCD) of up to $50,000 from an IRA to a new CRT or CGA in a single tax year. The $50,000 per owner cap is a lifetime limit on the funding coming from her IRA(s). She may not contribute additional amounts from her IRA or any other source to that CRT in future years, nor can she add funds from the IRA to a CRT that was previously funded with other assets. She also cannot direct funds from an IRA to fund another CRT or CGA in future years. Moreover, this funding must be accomplished all in one tax year.

- Only the IRA owner and the owner’s spouse are permitted beneficiaries/annuitants of the CRT or CGA. Note that donors may fund only immediate payment CGAs. The QCD cannot fund a deferred gift annuity or a flexible deferred gift annuity. Also, the income interest in the CRT and the annuity stream in the CGA must be non-assignable.

- 100% of the annual payments from the CRT or CGA must be taxed as ordinary income to the beneficiaries or annuitants. The payments must be reported on either Schedule K-1 (CRT) or 1099 (CGA).

- Because the distribution is treated as a QCD, the existing outright gift QCD rules that prohibit gifts to donor advised funds and supporting organizations also apply to these QCDs to CRTs and CGAs.

No Charitable Deduction

The donor cannot take a charitable income tax deduction for making this type of gift. However, the distribution will count against the donor’s required minimum distribution (RMD) from IRAs for that year. Also, the QCD directly from an IRA to a qualifying CRT or CGA under this new provision will not result in immediate income recognition for the donor. Instead, as they are made, she and her spouse will be taxed on the distributions from the life income gift.

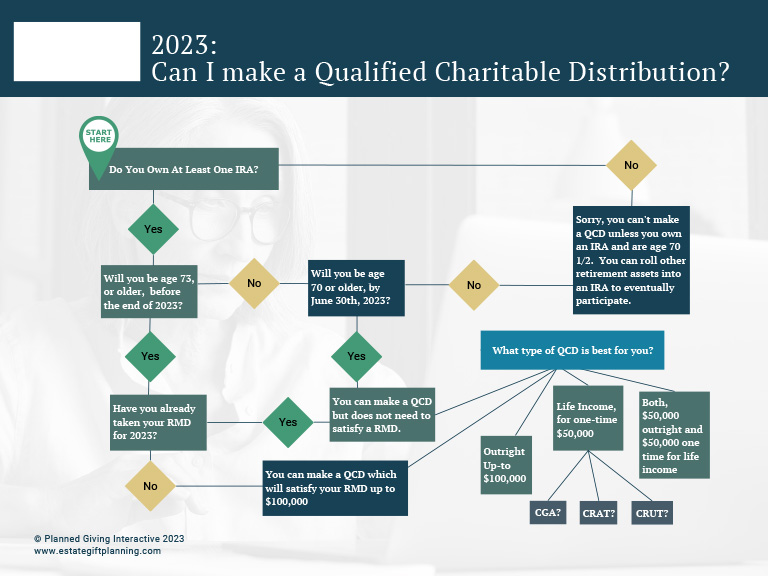

Flow Chart as a Tool to Explain the New RMD-QCD Decisions

Click image to download.

Immediately before Secure 2.0, the initial RMD age was 72 years, from the passing of SECURE 1.0 in December 2019 where the age was at 70½ for decades. With Secure 2.0 the initial RMD age increases immediately to 73 and will increase to 75 in 2033.

Because the QCD age of 70½ remains unchanged, it’s now bifurcated from the RMD age, increasing the complexity of discussing QCD and RMD planning with your clients. The attached flow chart can be valuable in walking your clients through their new planning considerations. Feel free to include your own organization’s logo in the top left section.

Let’s work together to help our clients/donors make a powerful charitable impact and reach their financial and estate planning goals!